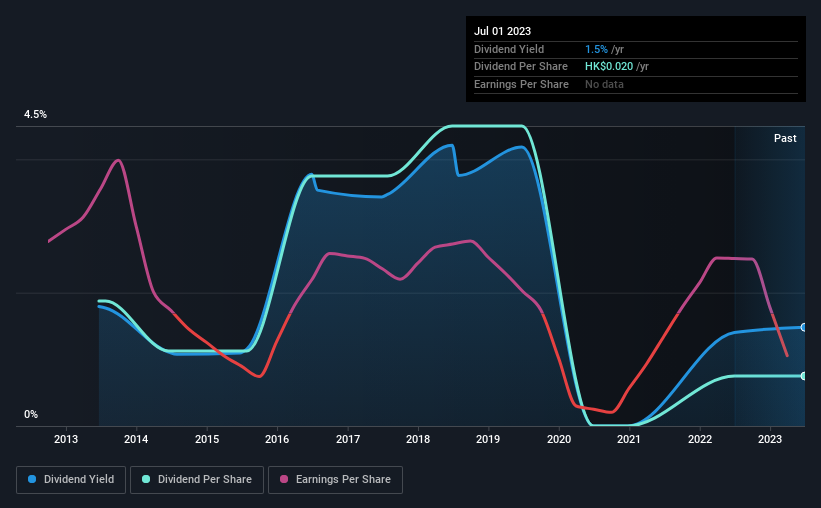

Yangtzekiang Garment Limited’s Investors in (HKG:294) are expected to receive HK$0.02 for each share by the 16th October. Dividend yield for this payment is 1,5%. This is lower than the industry’s average.

See our analysis on Yangtzekiang Garment

Yangtzekiang Garment’s Distributions May Be Difficult To Sustain

The current dividend levels of a company are also important to take into consideration. Yangtzekiang Garment may not be profitable but it pays less than 75% its free cash flows, meaning that the firm has plenty of money left to invest back into their business. As a general rule, cash flow has more importance than accounting measures for profit. We are therefore comfortable with the level of dividend.

The EPS is expected to continue falling in the coming year. The company is unprofitable, and the managers may have to decide whether they want to continue paying the dividends or reduce the pressure on the balance sheet.

Dividend Volatility

The company pays a dividend since a very long time. However, in the past 10 years it cut its dividends at least one. The annual dividend payment was HK$0.05 in 2013, compared with the latest full-year payout of HK$0.02. Around 8.8% of the dividend was reduced each year. Dividends that are declining can be a sign of a struggling company.

Dividend Growth is Limited

We need to see if the dividends are increasing. Yangtzekiang Garment appears to have seen its earnings per share (EPS) decline by around 15 percent a year over the past five. Dividends will be under pressure unless EPS is able to recover from the current nosedive.

Yangtzekiang Garment’s Dividend Doesn’t Look Sustainable

We don’t consider this company to be a good dividend stock even though it didn’t reduce its dividend this year. Although the company generates a lot of cash and could continue to pay a dividend for some time, the past performance has not been good. It would be prudent to not rely on the stock solely for dividend income.

Investors tend to prefer companies that have a stable, consistent dividend policy over those who do not. Investors should also consider other aspects of a business, aside from the dividend policy. We’ve identified some of the most important factors to consider. Two warning signs of Yangtzekiang Garment 1 is worrying! Before investing, you need to be informed. You might want to also check out our Dividend Investors section. List of dividend high-yielding stocks.

We make valuation simple.

Discover whether you are eligible for a loan Yangtzekiang Garment Our comprehensive analysis includes Fair value estimates are based on risks, warnings and dividends. Insider transactions, the financial state and health of the company can also be considered.

See the free analysis

You have feedback to give on the article you’ve read? Do you have any concerns about this article? Find out more Contact us today. Alternatively, email editorial-team (at) simplywallst.com.

The article Simply Wall St has a general nature. Our articles do not provide financial advice. They are based solely on analyst predictions and historical data. This does not represent a recommendation for you to purchase or sell any stocks, nor does it take into account your goals or financial status. Our goal is to provide you with a long-term analysis based on fundamental data. Our analysis does not always include qualitative information or the latest announcements from companies that are price-sensitive. Simply Wall St is not a shareholder in the companies mentioned.