Typically talking long run investing is the best way to go. However sadly, some firms merely do not succeed. To wit, the Shandong Ruyi Woolen Garment Group Co., Ltd. (SZSE:002193) share value managed to fall 62% over 5 lengthy years. That is an disagreeable expertise for long run holders. And it is not simply long run holders hurting, as a result of the inventory is down 57% within the final yr. The falls have accelerated lately, with the share value down 44% within the final three months.

Since Shandong Ruyi Woolen Garment Group has shed CN¥157m from its worth prior to now 7 days, let’s have a look at if the long term decline has been pushed by the enterprise’ economics.

See our newest evaluation for Shandong Ruyi Woolen Garment Group

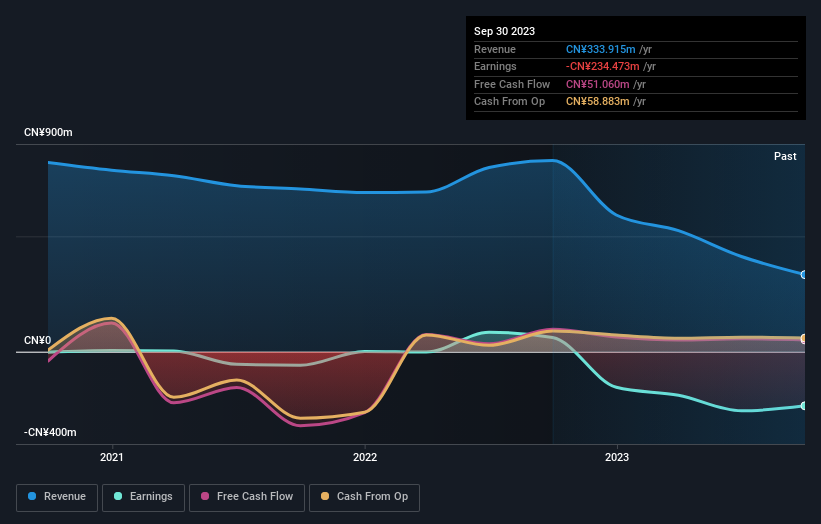

Provided that Shandong Ruyi Woolen Garment Group did not make a revenue within the final twelve months, we’ll give attention to income development to kind a fast view of its enterprise improvement. Shareholders of unprofitable firms normally count on sturdy income development. That is as a result of quick income development may be simply extrapolated to forecast earnings, usually of appreciable measurement.

Over half a decade Shandong Ruyi Woolen Garment Group diminished its trailing twelve month income by 22% for every year. That places it in an unattractive cohort, to place it mildly. It appears acceptable, then, that the share value slid about 10% yearly throughout that point. It is honest to say most buyers do not wish to spend money on loss making firms with falling income. You’d need to analysis this firm fairly totally earlier than shopping for, it seems a bit too dangerous for us.

You possibly can see how earnings and income have modified over time within the picture beneath (click on on the chart to see the precise values).

It is most likely value noting that the CEO is paid lower than the median at comparable sized firms. However whereas CEO remuneration is all the time value checking, the actually necessary query is whether or not the corporate can develop earnings going ahead. Earlier than shopping for or promoting a inventory, we all the time advocate a detailed examination of historic development traits, accessible right here..

A Totally different Perspective

We remorse to report that Shandong Ruyi Woolen Garment Group shareholders are down 57% for the yr. Sadly, that is worse than the broader market decline of 16%. Nonetheless, it may merely be that the share value has been impacted by broader market jitters. It may be value keeping track of the basics, in case there is a good alternative. Regrettably, final yr’s efficiency caps off a nasty run, with the shareholders dealing with a complete lack of 10% per yr over 5 years. We realise that Baron Rothschild has stated buyers ought to “purchase when there’s blood on the streets”, however we warning that buyers ought to first ensure they’re shopping for a top quality enterprise. It is all the time fascinating to trace share value efficiency over the long term. However to grasp Shandong Ruyi Woolen Garment Group higher, we have to contemplate many different elements. Living proof: We have noticed 2 warning indicators for Shandong Ruyi Woolen Garment Group try to be conscious of.

We are going to like Shandong Ruyi Woolen Garment Group higher if we see some huge insider buys. Whereas we wait, take a look at this free listing of rising firms with appreciable, latest, insider shopping for.

Please notice, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on Chinese language exchanges.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Shandong Ruyi Woolen Garment Group is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.