Key Insights

- Lai Solar Garment (Worldwide) will host its Annual Basic Assembly on fifteenth of December

- Wage of HK$9.36m is a part of CEO Chai Tuck Yip’s complete remuneration

- Whole compensation is 350% above trade common

- Lai Solar Garment (Worldwide)’s three-year loss to shareholders was 80% whereas its EPS grew by 37% over the previous three years

Shareholders of Lai Solar Garment (Worldwide) Restricted (HKG:191) may have been dismayed by the unfavorable share value return during the last three years. Nonetheless, what’s uncommon is that EPS progress has been constructive, suggesting that the share value has diverged from fundamentals. The AGM developing on the fifteenth of December could possibly be a chance for shareholders to carry these considerations to the board’s consideration. Voting on resolutions reminiscent of govt remuneration and different issues is also a solution to affect administration. We focus on under why we expect shareholders must be cautious of approving a increase for the CEO in the intervening time.

Try our newest evaluation for Lai Solar Garment (Worldwide)

How Does Whole Compensation For Chai Tuck Yip Evaluate With Different Corporations In The Business?

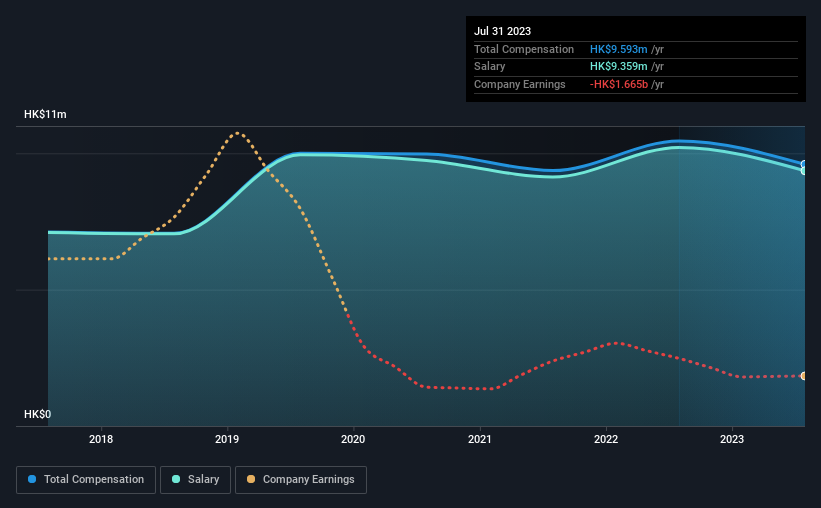

Based on our information, Lai Solar Garment (Worldwide) Restricted has a market capitalization of HK$804m, and paid its CEO complete annual compensation value HK$9.6m over the yr to July 2023. We notice that is a lower of 8.2% in comparison with final yr. Particularly, the wage of HK$9.36m, makes up an enormous portion of the overall compensation being paid to the CEO.

For comparability, different firms within the Hong Kong Actual Property trade with market capitalizations under HK$1.6b, reported a median complete CEO compensation of HK$2.1m. This implies that Chai Tuck Yip is paid greater than the median for the trade.

| Part | 2023 | 2022 | Proportion (2023) |

| Wage | HK$9.4m | HK$10m | 98% |

| Different | HK$234k | HK$234k | 2% |

| Whole Compensation | HK$9.6m | HK$10m | 100% |

On an trade stage, roughly 77% of complete compensation represents wage and 23% is different remuneration. Buyers will discover it fascinating that Lai Solar Garment (Worldwide) pays the majority of its rewards by a standard wage, as a substitute of non-salary advantages. If complete compensation veers in direction of wage, it means that the variable portion – which is usually tied to efficiency, is decrease.

Lai Solar Garment (Worldwide) Restricted’s Development

Lai Solar Garment (Worldwide) Restricted has seen its earnings per share (EPS) enhance by 37% a yr over the previous three years. It noticed its income drop 7.3% during the last yr.

This demonstrates that the corporate has been bettering just lately and is sweet information for the shareholders. Whereas it might be good to see income progress, earnings matter extra ultimately. We do not have analyst forecasts, however you can get a greater understanding of its progress by testing this extra detailed historic graph of earnings, income and money circulate.

Has Lai Solar Garment (Worldwide) Restricted Been A Good Funding?

With a complete shareholder return of -80% over three years, Lai Solar Garment (Worldwide) Restricted shareholders would by and enormous be dissatisfied. So shareholders would in all probability need the corporate to be much less beneficiant with CEO compensation.

In Abstract…

Lai Solar Garment (Worldwide) pays its CEO a majority of compensation by a wage. Regardless of the expansion in its earnings, the share value decline up to now three years is definitely regarding. An enormous lag in share value progress when earnings have grown could point out there could possibly be different points which can be affecting the corporate in the intervening time that the market is targeted on. Shareholders could be eager to know what’s holding the inventory again when earnings have grown. These considerations must be addressed on the upcoming AGM, the place shareholders can query the board and consider if their judgement and choice making continues to be in step with their expectations.

We are able to study so much about an organization by finding out its CEO compensation traits, together with taking a look at different points of the enterprise. We recognized 3 warning indicators for Lai Solar Garment (Worldwide) (2 do not sit too effectively with us!) that you need to be conscious of earlier than investing right here.

Arguably, enterprise high quality is rather more necessary than CEO compensation ranges. So take a look at this free record of fascinating firms which have HIGH return on fairness and low debt.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Lai Solar Garment (Worldwide) is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by elementary information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.